Injured in an Uber? Here’s What Your Colorado Settlement Could Be Worth

Injured in an Uber? Here’s What Your Colorado Settlement Could Be Worth

Introduction

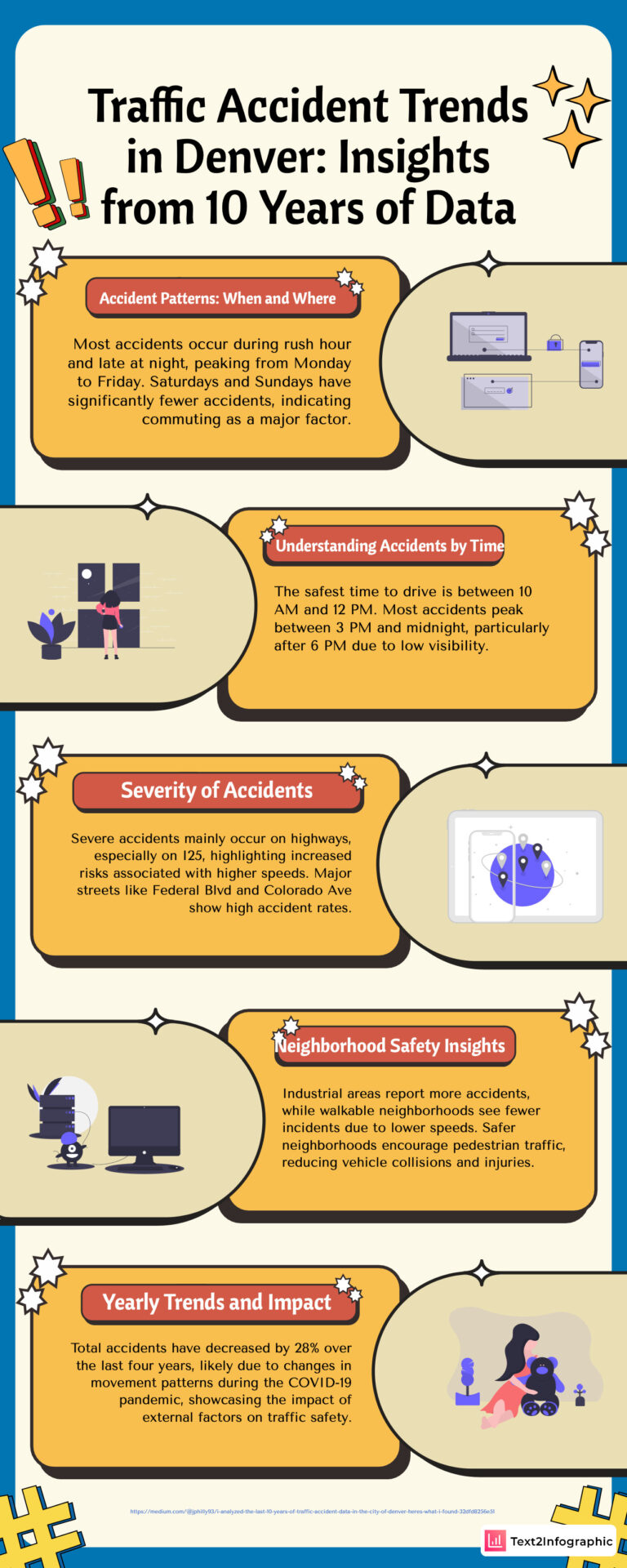

The rideshare revolution has dramatically transformed transportation in Colorado, with services like Uber and Lyft becoming integral to the daily lives of residents in Denver, Colorado Springs, and throughout the state. According to recent statistics, nearly 30,000 rideshare drivers were operating in Colorado in 2024, providing millions of rides annually. While these services offer convenience and accessibility, they have also introduced new complexities to the roadways and, unfortunately, a corresponding increase in accidents.

Rideshare accidents in Colorado present unique challenges compared to standard auto accidents. The multilayered insurance policies, questions of driver status, and complex liability issues make these cases particularly difficult to navigate for injury victims. Recent data indicates that ridesharing has contributed to a 2-3% increase in traffic fatalities across the United States, reflecting a broader trend that impacts Colorado as well.

This blog post aims to provide critical information for victims of rideshare accidents in Colorado, helping them understand the potential value of their settlements and the key factors that influence compensation amounts. If you’ve been injured while using a rideshare service, understanding these elements can be crucial to ensuring you receive fair compensation for your injuries and losses.

Understanding Rideshare Insurance Coverage in Colorado

Rideshare insurance coverage in Colorado operates on a tiered system that depends on the driver’s status at the time of the accident. Understanding these tiers is essential to determining potential settlement values. When a rideshare driver causes an accident while not logged into the app, their personal auto insurance applies. Colorado requires minimum liability coverage of $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $15,000 for property damage. This represents the lowest tier of coverage and often proves insufficient for serious injuries.

The coverage increases significantly when the app is on but the driver is waiting for a ride request. In this scenario, both Uber and Lyft provide substantially higher coverage: $50,000 per person for bodily injury, $100,000 per accident for bodily injury, and $30,000 for property damage. This enhanced coverage offers greater protection for accident victims compared to when the app is off.

The most substantial coverage applies during active rides. When a driver is en route to pick up a passenger or during an active ride, both Uber and Lyft provide up to $1 million in liability coverage. This comprehensive coverage includes mandatory uninsured/underinsured motorist coverage and contingent comprehensive and collision coverage, offering substantial protection for passengers.

Colorado has implemented specific requirements that differentiate rideshare insurance from standard auto policies. Thanks to House Bill 22-1089, which was signed into law in 2022 and remains in effect in 2025, transportation network companies or their drivers must secure insurance protection for drivers and riders against damages caused by uninsured motorists. This coverage must be at least $200,000 per person and $400,000 per occurrence. Colorado’s unique terrain and weather conditions have also prompted additional insurance requirements for rideshare operations in mountain areas and during winter conditions. These provisions offer additional protection for both passengers and drivers navigating the state’s challenging roadways.

House Bill 22-1089 has significantly strengthened protections for rideshare passengers in Colorado, particularly in hit-and-run scenarios and accidents involving uninsured motorists. Prior to this legislation, passengers who didn’t have their own auto insurance policies were often left without recourse when accidents were caused by uninsured drivers or hit-and-run incidents. The bill was inspired by a 2020 case where a Lyft passenger suffered severe injuries in a hit-and-run accident, including five shattered vertebrae and a broken jaw, resulting in approximately $167,000 in medical bills. With no personal auto insurance and limited legal options, the passenger faced financial ruin until this legislative change. This law ensures that even if you don’t own a car or carry personal auto insurance, you’re protected when using rideshare services in Colorado.

Key Factors That Determine Your Uber Accident Settlement Value

The nature and extent of your injuries significantly impact settlement values in rideshare accident cases. Minor injuries such as soft tissue injuries, minor whiplash, and sprains typically result in smaller settlements, often ranging from $10,000 to $50,000, depending on recovery time and impact on daily activities. Moderate injuries including broken bones, significant scarring, and concussions generally warrant higher settlements, potentially between $50,000 and $100,000, particularly if they require extensive medical intervention or rehabilitation. Severe or catastrophic injuries like traumatic brain injuries, spinal cord damage, and multiple fractures can result in settlements exceeding $100,000 and potentially reaching the policy limits of $1 million in cases of permanent disability or long-term impairment. Injuries resulting in permanent disability or requiring lifelong care dramatically increase potential settlement values, as they must account for ongoing medical expenses and diminished quality of life.

Quantifiable financial losses form the foundation of rideshare accident settlements. Medical expenses, including current and projected future medical costs, are typically the largest component of economic damages. These include emergency treatment, hospitalization, surgeries, medication, physical therapy, and any anticipated future medical interventions related to your injuries. Compensation for time missed from work is calculated based on your established earnings. If your injuries affect your ability to earn at the same level in the future, this diminished earning capacity becomes a significant factor in settlement calculations. While often smaller than bodily injury claims, compensation for damaged personal property (smartphones, laptops, etc.) should be included in your settlement demands.

Less tangible losses can significantly impact settlement values. Physical discomfort and pain resulting from injuries are compensable, with values generally increasing with the severity and duration of pain. Psychological impacts like anxiety, depression, PTSD, and sleep disturbances resulting from the accident can substantially increase settlement values, particularly when documented by mental health professionals. If your injuries prevent participation in previously enjoyed activities or diminish your overall quality of life, these impacts warrant additional compensation.

Colorado follows a modified comparative negligence system that directly impacts settlement amounts. Under Colorado law, you can recover damages as long as you are less than 50% responsible for the accident. If you are found to be 50% or more at fault, you cannot recover any compensation. Your settlement amount will be reduced by your percentage of fault. For example, if your total damages are $100,000 and you’re determined to be 20% at fault, your maximum recovery would be $80,000. Comparative negligence can arise in various scenarios, such as not wearing a seatbelt or distracting the driver. Insurance companies often attempt to assign partial blame to passengers to reduce settlement amounts.

Colorado’s Collateral Source Rule and Its Impact on Settlements

Colorado’s collateral source rule, codified in C.R.S. § 13-21-111.6, prevents reduction of your settlement based on compensation received from sources other than the at-fault party. This legal principle ensures that defendants cannot benefit from your foresight in having insurance or other benefits. The rule generally states that a court must reduce a verdict by amounts compensated through a collateral source. However, there’s a critical exception: no reduction applies for payments made because of a contract entered into by the victim or for the victim.

When your health insurance covers medical expenses from a rideshare accident, the collateral source rule’s contract exception typically applies. Under Colorado law, the full amount of your medical bills (not just what your insurance paid) can generally be presented as damages, potentially increasing your settlement value. The defendant cannot reduce their liability because your health insurance covered some expenses. This prevents the wrongdoer from benefiting from your insurance coverage.

The contract exception is particularly significant for rideshare accident victims, as it applies to various payment sources. Since you pay premiums for health insurance, these benefits fall under the contract exception and don’t reduce your settlement. Courts have ruled that Medicare benefits qualify under the contract exception when the plaintiff has contributed to Social Security. Payments from disability insurance policies you’ve purchased don’t reduce the defendant’s liability.

While the collateral source rule protects your right to full compensation, medical liens can significantly affect your final settlement. Hospitals and providers may place liens against your settlement to recover unpaid medical bills. Your health insurer may have a right to be reimbursed from your settlement for medical expenses they covered. Government insurers have statutory rights to recover payments from your settlement, and these liens must be addressed before disbursing funds. An experienced Colorado rideshare accident attorney can often negotiate these liens, potentially increasing your net recovery from the settlement.

Average Uber Accident Settlement Ranges in Colorado

While every case is unique, understanding average settlement ranges can provide helpful context when evaluating your claim. For minor injuries like strains, sprains, and minor whiplash, settlements typically range from $10,000 to $25,000, covering medical bills, limited lost wages, and modest pain and suffering. Superficial injuries with minimal medical intervention generally result in settlements between $5,000 and $15,000, depending on recovery time and any scarring. For most minor injuries from rideshare accidents in Colorado, settlements typically fall between $5,000 and $50,000, reflecting the enhanced insurance coverage available during active rides.

Moderate injuries often command higher compensation. Fractures requiring casting or surgical intervention generally result in settlements ranging from $50,000 to $100,000, depending on recovery time and any lasting limitations. Visible scarring, particularly on the face or other prominent areas, can increase settlement values substantially, often ranging from $25,000 to $75,000 on top of other damages. Even “mild” traumatic brain injuries can result in meaningful settlements between $50,000 and $150,000, particularly when symptoms persist beyond the immediate recovery period. Moderate injuries from Colorado rideshare accidents typically result in settlements ranging from $50,000 to $200,000, reflecting the need for more extensive medical treatment and longer recovery periods.

Severe injuries can lead to substantial settlements approaching policy limits. Moderate to severe TBIs can result in settlements reaching or exceeding the policy limits of $1 million, particularly when long-term care is required. Injuries resulting in partial or complete paralysis often warrant maximum policy limits of $1 million, though these amounts may still be insufficient for lifetime care needs. Complex breaks requiring surgical intervention and extended rehabilitation typically result in settlements between $200,000 and $500,000. The most severe rideshare accident injuries in Colorado generally result in settlements ranging from $500,000 to the full policy limit of $1 million. When multiple insurance policies apply or when punitive damages are warranted, settlements can potentially exceed this amount.

The Settlement Process for Uber Accidents in Colorado

The settlement process typically follows distinct stages, though timelines vary based on case complexity. The immediate post-accident phase (0-2 weeks) includes medical treatment, accident reporting, and initial documentation of the incident. During the investigation period (1-3 months), insurance companies gather evidence, take statements, and evaluate the claim. This may include reviewing the rideshare company’s data about the trip. The treatment and documentation phase (2-12 months) involves completing medical treatment or reaching maximum medical improvement, establishing the full extent of your injuries. During the demand and negotiation phase (1-3 months), your attorney presents a demand package to the insurance companies, followed by negotiation of the settlement amount. Most cases settle during negotiations, but some proceed to litigation if a fair settlement cannot be reached. The entire process typically takes 6-18 months for moderate cases, though complex or severe injury cases may take longer.

Rideshare accident claims often involve multiple insurers, complicating the settlement process. The primary coverage during active rides comes from Uber or Lyft’s commercial policies. The driver’s personal insurance may apply in certain situations, particularly if the driver was not logged into the app. Your uninsured/underinsured motorist coverage or personal injury protection may apply in specific circumstances. If multiple vehicles were involved, additional insurance companies may be part of the settlement process. Coordinating these various coverage sources requires experienced legal representation to ensure all available policies are properly leveraged.

Thorough documentation significantly impacts settlement values. Comprehensive records of all treatments, diagnoses, and provider recommendations form the foundation of your claim. Official police reports establish key facts about the accident and often assign preliminary fault. Data from the app showing the driver’s status, route, and other trip details can be crucial evidence. Accounts from other passengers or bystanders can strengthen your claim and counter any attempts to assign comparative fault. Pay stubs, tax returns, and employer statements documenting lost income significantly strengthen your claim for economic damages.

Most rideshare accident claims resolve through settlement rather than court judgments. Many cases settle after demand presentation but before filing a lawsuit, typically resulting in faster resolution. Filing a lawsuit often accelerates serious settlement negotiations, even if the case ultimately settles before trial. Only a small percentage of cases proceed to trial, but the potential for a jury verdict often motivates more favorable settlement offers.

Colorado law gives accident victims three years from the accident date to file a personal injury lawsuit. Missing this deadline typically bars you from receiving any compensation, regardless of your case’s merit. For rideshare accident cases, this three-year window is particularly important due to the complex investigation often required.

How an Experienced Colorado Rideshare Accident Attorney Maximizes Your Settlement

An experienced attorney ensures all aspects of your damages are properly valued. This includes working with medical experts to project future treatment needs and costs, calculating not just direct wage losses but also impacts on benefits, promotions, and career trajectory, and systematically analyzing how your injuries affect your quality of life, relationships, and emotional well-being.

Specialized knowledge of rideshare policies gives attorneys leverage in negotiations. They understand exactly what coverage applies based on the driver’s status, are familiar with common tactics used by rideshare insurers to minimize settlements, and can use Colorado insurance regulations to prevent unreasonable claim denials or delays.

Attorneys employ systematic approaches to evidence gathering, including preventing the destruction of app data, vehicle information, and other critical evidence through early preservation notices. They can use formal discovery processes to obtain data that individuals cannot access independently and work with experts to establish precisely how the accident occurred and who bears responsibility.

Strategic use of expert witnesses strengthens settlement positions. Medical experts can testify about injury severity, treatment needs, and long-term prognosis. Financial experts can calculate lifetime costs of injuries and economic losses. Accident reconstructionists can establish fault using scientific principles and evidence analysis.

When necessary, attorneys develop comprehensive litigation approaches, including strategic use of court procedures to maintain pressure on insurance companies, developing compelling presentations that insurers know would be effective with jurors, and skilled use of mediation and arbitration to achieve favorable settlements without protracted litigation.

Real Case Examples from Colorado

A 34-year-old passenger sustained soft tissue neck and back injuries when his Uber driver was rear-ended in downtown Denver. The passenger underwent three months of physical therapy for whiplash and experienced lingering discomfort for six months. The case settled for $22,500, covering $8,700 in medical expenses, $3,800 in lost wages, and $10,000 for pain and suffering. The clear liability (rear-end collision) and well-documented medical treatment facilitated a relatively quick settlement within six months of the accident.

In another case, a 52-year-old business traveler suffered a broken wrist and facial lacerations when her Lyft driver ran a red light in Colorado Springs. The passenger required surgical intervention for the wrist fracture, resulting in a metal plate and screws, plus treatment for facial scarring. The case settled for $143,000, covering $47,000 in medical expenses, $26,000 in lost income, and $70,000 for pain, suffering, and permanent scarring. The clear liability (traffic violation) and permanent physical consequences (reduced wrist mobility and visible scarring) justified the substantial non-economic damages portion of the settlement.

In a severe case, a 27-year-old passenger sustained a traumatic brain injury and multiple fractures when his Uber driver lost control on icy mountain roads near Vail. The passenger required emergency neurosurgery, multiple orthopedic procedures, and extensive cognitive and physical rehabilitation. After litigation was initiated, the case settled for $875,000, covering $392,000 in medical expenses, $183,000 in lost earning capacity, and $300,000 for pain, suffering, and permanent cognitive impairments. The complex liability (weather conditions versus driver error) and catastrophic, life-altering injuries resulted in extensive litigation before reaching settlement approximately 20 months after the accident.

These Colorado cases illustrate several important patterns. The substantial insurance requirements for active rideshare trips enabled meaningful recovery in all cases. Maximum settlements typically occur after completing treatment or reaching maximum medical improvement. Settlement amounts directly correlate with the thoroughness of injury documentation and economic impact evidence. All three cases benefited from early attorney involvement, proper evidence preservation, and strategic negotiation approaches.

Steps to Take After an Uber Accident and Conclusion

Taking proper steps immediately after an accident significantly impacts potential settlements. Even if injuries seem minor, get evaluated by medical professionals. Some serious conditions, like concussions or internal injuries, may not be immediately apparent. Notify the police and ensure an official accident report is filed. Colorado law requires reporting accidents involving injuries. Take photos of vehicle damage, the accident location, road conditions, and visible injuries before leaving the scene. Report the accident through the rideshare app’s safety features, creating an official record with the company.

Thorough medical records form the foundation of your claim. Attend all recommended appointments and comply with treatment protocols. Document pain levels, limitations, and how injuries affect daily activities. Ensure medical reports clearly connect your injuries to the accident and detail their impact on your life. Gaps in treatment can be used by insurance companies to argue that injuries weren’t serious or weren’t caused by the accident, so don’t delay treatment.

How you interact with insurers can significantly affect your settlement. Avoid giving recorded statements or signing releases without legal counsel. Once represented, let your attorney handle all insurance communications. Early offers rarely account for the full extent of injuries and losses. Keep records of all communications with insurance representatives, including dates, names, and discussion points.

Your online presence can impact your claim. Set all social media accounts to private during the claims process. Never post details about the accident or your injuries online. Photos or check-ins showing physical activities could be used to dispute your injury claims. The safest approach is to refrain from social media use entirely until your claim resolves.

The timing of legal representation significantly impacts outcomes. The sooner an attorney can begin evidence preservation, the stronger your claim will be. Contact an attorney before providing any formal statements to insurance companies. When multiple parties are involved or liability is disputed, legal representation becomes particularly crucial.

Rideshare accidents in Colorado present unique challenges due to the complex insurance structures, multiple potentially liable parties, and specific state laws governing these relatively new transportation services. Understanding the factors that influence settlement values—from insurance coverage tiers to injury severity to Colorado’s comparative negligence and collateral source rules—is essential for accident victims seeking fair compensation.

The settlement ranges discussed provide general guidelines, but every case is unique. Minor injuries might result in settlements from $5,000 to $50,000, moderate injuries typically range from $50,000 to $200,000, and severe injuries can warrant settlements from $500,000 to $1 million or beyond in cases of catastrophic harm.

The path to maximum compensation requires prompt action, thorough documentation, appropriate medical care, and strategic legal representation. By understanding the settlement process and taking proper steps following an accident, rideshare injury victims can significantly improve their chances of receiving fair compensation that truly addresses both their immediate needs and long-term consequences.

If you’ve been injured in an Uber, Lyft, or other rideshare accident in Colorado, experienced legal representation can make the difference between a minimal settlement and full compensation for all your losses. At Kennedy Injury Lawyers, our team brings over fifteen years of experience to rideshare accident cases, ensuring that victims receive the settlement they deserve.

Frequently Asked Questions

What if the Uber driver was at fault vs. another driver? If your Uber driver was at fault, you would file a claim against Uber’s commercial liability policy, which provides up to $1 million in coverage during active rides. If another driver caused the accident, you would file against that driver’s personal insurance, but Uber’s uninsured/underinsured motorist coverage would apply if the at-fault driver lacks adequate insurance—providing up to $1 million in protection.

How long does an Uber accident settlement take in Colorado? Most rideshare accident settlements in Colorado take between 6-18 months from the date of the accident. Minor injury cases may resolve in as little as 3-6 months, while severe injury cases, particularly those requiring litigation, can take 24 months or longer. The timeline largely depends on the severity of injuries, clarity of liability, and whether settlement negotiations or litigation is required.

Can I still recover damages if I was partially at fault? Yes, under Colorado’s modified comparative negligence law, you can recover damages as long as you were less than 50% responsible for the accident. However, your compensation will be reduced by your percentage of fault. For example, if you’re found 20% at fault and your damages total $100,000, your maximum recovery would be $80,000.

Will my health insurance affect my settlement? Thanks to Colorado’s collateral source rule, payments from your health insurance typically won’t reduce your settlement amount from the at-fault party. However, your health insurer may have a right to be reimbursed from your settlement for medical expenses they covered (known as subrogation). An experienced attorney can often negotiate these liens to maximize your net recovery.

What if the Uber driver’s insurance denies my claim? If the driver’s personal insurance denies your claim (which often happens if they don’t have a rideshare endorsement), Uber’s insurance policy should still provide coverage depending on the driver’s status at the time of the accident. If you were a passenger during an active trip, Uber’s $1 million liability policy would apply regardless of the driver’s personal insurance situation.

How are attorney fees typically structured in rideshare accident cases? Most rideshare accident attorneys in Colorado work on a contingency fee basis, meaning they receive a percentage of your settlement or verdict rather than charging hourly fees. This percentage typically ranges from 30% to 40%, depending on case complexity and whether litigation is required. This structure allows access to legal representation without upfront costs and aligns the attorney’s interests with maximizing your recovery.

For a free consultation regarding your rideshare accident case, contact Kennedy Injury Lawyers at 720.808.0706.